Earning above average returns for our investors

Gain steady consistent income, stability, and growth without management burdens.

Who We Are

Meet SIG FUND

SIG FUND is a leading real estate fund and mission is to build trusted, long-term relationships with our team and investors through clear communication, shared objectives, and disciplined execution. We focus on meaningful growth—financial and professional—while minimizing risk and fostering enduring success for everyone we work with.

How We Help

Investment Focus

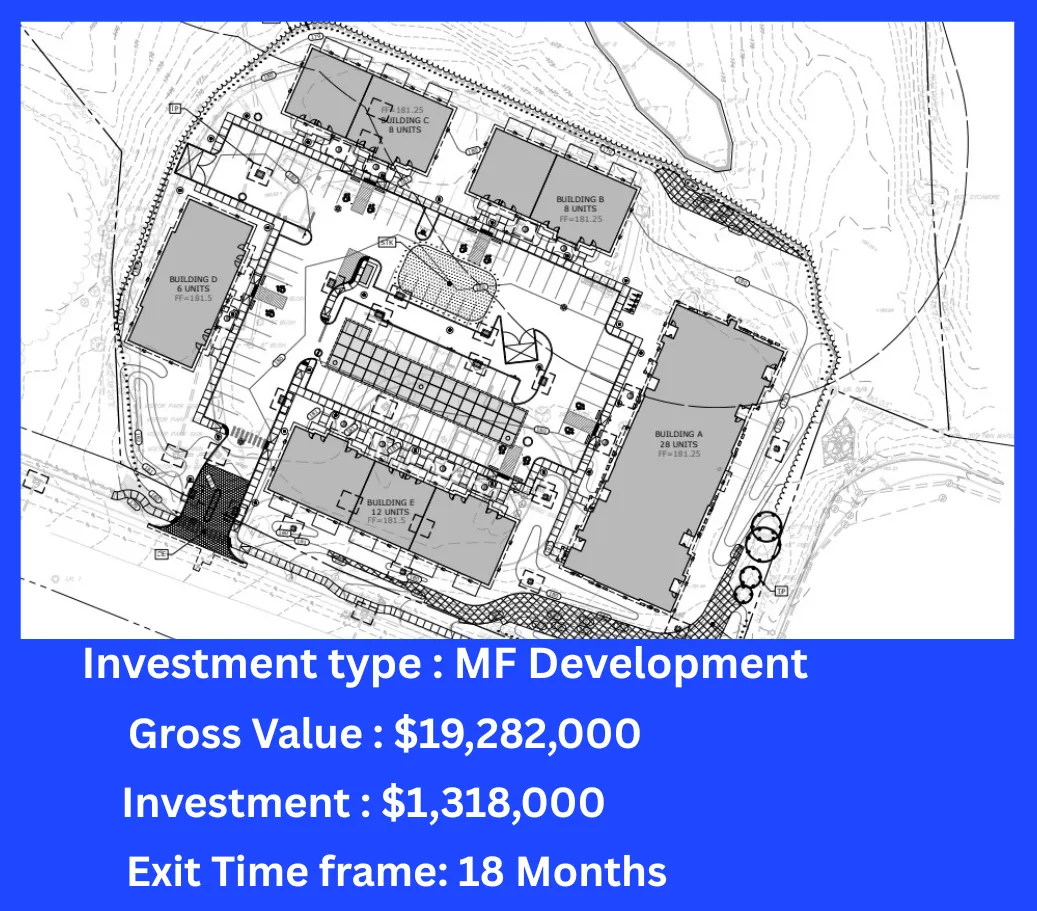

At SIG Fund, our investment focus is centered on land development and ground up new construction. From land entitlement through vertical development, our experienced team executes single-family and multifamily projects, transforming raw land into completed, income-producing properties and communities.

Land entitlement

Development of residential subdivisions

New build residential construction

New build multifamily construction

750+

Lots entitled and or developed

40+

Combined Years of Experience

110+ Million

Project Value managed

**Previous and targeted returns represent goals that may or may not be achieved and are based on forward-looking assumptions that may not materialize. Investments are offered only to verified accredited investors who can bear the risk of loss. Since 2004, Investors directly or indirectly have participated in a wide range of real estate investment offerings, including acquisition, entitlement, development, lease-up, and disposition phases with SIG Fund(s) Manager, sister funds, affiliates, entities, partners and/or its co fund of fund managers. As projects progress through their respective holding periods, performance metrics will be updated to reflect the most current available data. All figures are calculated net of fees. Last update: 1/2026.**

How We Strive

Clients' Voices

Testimonials from our satisfied Investors and Partners.

John C.

“Investing with SIG Fund has been one of the most seamless and rewarding experiences I’ve had as an accredited investor. The communication was consistent, the underwriting was transparent, and the team delivered exactly what they projected. My investment performed as expected, distributions arrived on time, and the exit occurred without surprises. SIG Fund has earned my confidence, and I fully intend to reinvest in future offerings.”

John C.

Michael W.

“I’ve invested with several real estate groups over the years, and SIG Fund stands out above the rest. They actually do what they say they’re going to do. The team executed the plan exactly as outlined, kept the project on schedule, and delivered the returns we were targeting. I felt informed, protected, and respected as an investor. I’m already reviewing their next offering.”

Michael W.

Elizabeth J.

“I had a great experience investing with SIG Fund. Everything was clearly explained from day one, and the team kept me updated throughout the entire process. My return came in exactly as projected, and the professionalism was top-notch. I’ll definitely be investing with them again.”

Elizabeth J.

Why SIG Fund?

Frequently Asked Questions

Clear answers to help you make confident investment decisions.

What is SIG Fund?

SIG Fund is a registered 506c Reg D private real estate investment fund focused on land development and ground-up new construction, including single-family and multifamily communities. The fund targets opportunities where disciplined entitlement, development, and execution can drive attractive risk-adjusted returns.

What types of investments does SIG Fund focus on?

SIG Fund primarily invests in:

- Land entitlement and horizontal development

- Ground-up single family and multifamily construction

- Select build-to-rent communities

Investments are typically located in high-growth markets with strong demographic and housing demand fundamentals.

Who can invest in SIG Fund?

Investments in SIG Fund are available only to accredited investors, as defined by SEC regulations.

“An accredited investor is an individual or entity that meets specific income or net-worth thresholds established by the SEC. Accredited investors are permitted to participate in certain private offerings that are not registered with the SEC.

To qualify as an individual accredited investor:

Income: Earn at least $200,000 individually (or $300,000 jointly with a spouse/partner) for the past two years, with a reasonable expectation of maintaining or increasing that income in the current year.

Net Worth: Possess a net worth of more than $1,000,000, either individually or jointly, excluding the value of your primary residence.”

What is SIG Fund’s investment strategy?

SIG Fund’s strategy centers on:

- Acquiring or controlling land at favorable bases

- Creating value through entitlement, zoning, and development

- Executing disciplined new construction

- Monetizing projects through sale, refinance, or long-term ownership

The fund emphasizes capital preservation alongside upside participation.

What is the typical investment timeline?

Investment timelines vary by project, municipality and jurisdiction.

Typically timelines for certain projects should be as follows:

- SFH New Construction 6-9 months

- Land entitlement PPA "Preliminary plat approval" 6-14 months

- Developed subdivision fully finished lots 15-28 months

- MF New Construction 18-36 months

Most opportunities have an expected horizon of 9–36 months, depending on size, entitlement complexity, construction timelines, and market conditions.

How are returns generated?

Returns are generated through:

- Land value creation via entitlement and development

- Construction and lease-up of multifamily assets

- Sale or recapitalization of completed projects

- Distributions are created through project cash flow, refinancing events, and asset exits.

Does SIG Fund offer a preferred return?

Yes. SIG Fund offers a preferred return, The preferred return is typically 6% to 8%, depending on the amount invested and the specific offering.

Preferred return terms, including calculation methodology and distribution timing, are detailed in the applicable offering documents.

How does SIG Fund manage risk?

Risk management includes:

- Conservative underwriting assumptions

- Low leverage standards (50-70%) to value

- Controlling assets to exit limiting substantial risk and cash exposure

- Market and zoning diligence

- Required deposit allocations from end buyers of projects reducing risk

- Phased capital deployment reducing risk

- Value engineering development and construction increasing bottom line

- Diversification across projects and asset types, when applicable

Does SIG Fund develop projects internally or with partners?

SIG Fund may develop projects internally, through affiliated development entities, or alongside strategic partners. This structure allows operational efficiency while managing risk and aligning incentives.

How is investor capital used?

Investor capital is generally used for:

- Land acquisition or control

- Entitlement and development costs

- Construction and infrastructure

- Project-level expenses and reserves

**Specific use of funds is outlined in each offering’s documentation.

How are investors kept informed?

Investors receive periodic updates that may include:

- Project progress reports

- Construction and entitlement milestones

- Financial summaries

- Market commentary

Communication cadence varies by project and fund structure.

Are there fees are associated with investing in SIG Fund?

No. SIG Fund does not charge fees to its investors.

There are no subscription, acquisition, investment, management, servicing, withdrawal, disposition or penalty fees in conjunction with SIG Fund Offering. The Manager will be compensated based solely on performance.

How does SIG Fund align interests with investors?

SIG Fund principals typically invest alongside investors and earn compensation primarily through successful project execution and performance, Aligning interests over the life of each investment.

Do I need a large investment to work with you?

No. SIG Fund is structured to be accessible to accredited investors without requiring an exceptionally large initial commitment. The minimum investment is $25,000, and investments may be fractionalized above that amount, allowing investors to scale their allocation over time and diversify across opportunities as they choose.

Specific minimums and allocation options may vary by offering and are outlined in the applicable offering documents.

How do I get started with SIG Fund?

Interested investors can:

1. Request access to offering materials

2. Complete accreditation verification

3. Review and execute subscription documents

A member of the SIG Fund team will guide investors through the process.

Where can I learn more or request offering details?

You may contact SIG Fund directly through the website "contact us" or investor portal to request additional information, offering documents, or to speak with a member of the investment team.

Are returns guaranteed?

No. All investments involve risk, and returns are not guaranteed. Project performance depends on market conditions, execution, financing, and other factors. Investors should be able to bear the loss of their investment.

Get Started

Ready to work with us?

Lets create a personalized investment plan that puts your goals within reach - starting today.

SIG Fund is a real estate investment firm focused on land acquisition, entitlement, residential development, and multifamily investments across high-growth U.S. markets.

Quick Links

Social Media Links

Copyright 2026. SIG FUND LLC All Rights Reserved. Privacy Policy and Terms of Use. **This website is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities. Any offering will be made solely pursuant to definitive offering documents and only to accredited investors.**